Tuesday, July 25, 2006

Artificial Pancreas for Diabetes: The Closed Loop Pump/Monitor

At the 66th Scientific Sessions of the annual American Diabetes Association meeting, there was considerable focus on efforts to develop the artificial pancreas. Rather than summarize those efforts myself, I instead provide this excellent review by Andrew B. Muir, MD, on Medscape.

The possibility remains for stem cell research to enable pancreatic cell transplant or similar cell based therapies, since the restriction on federal funding is regressive but destined to succumb to more enlightened consideration of the issue -- science and ethics -- than is possible with the current administration.

Tags: medtech, diabetes, glucose

Wednesday, July 19, 2006

Local Market Volume of Medical/Surgical Procedures

As I mentioned, the Medicare 100% file is large (measured in gigabytes) unwieldy and, as anyone who has purchased raw data from the U.S. government can attest, the file is not constructed in the most convenient format to allow simply queries, summaries or other processes that will reveal meaninful insights. And, given the cost, the need for HIPAA-related disclosure agreements to be signed,m the dataset is not quite amenable to data analyst with occasional interest or need in purusing it. Lastly -- and this goes for all reimbursement or discharge survey datasets -- whatever logic may govern the coding systems (DRG, ICD-9 and CPT4) used in this data, the reality of how clinicians fle claims and how survey data is collected can result requires that working with claims-based and survey-based datasets be done by someone with experience in these issues.

Now you might understand why the question, "So if this is in the public domain, how is your product in any way unique?" causes me to take a breath before answering.

MMD has joined with Medical Technology Partners (MTP) to capitalize on MTP's use of these large datasets, which have been acquired for reimbursement consulting, to use them for answerng very technology-specific and facility-specific questions raised by medical product manufacturers.

Tags: medtech, hospitals, utilization data

Tuesday, July 18, 2006

Top Volume Hospitals by DRG, ICD-9

We had no idea when we started offering clinical utilization data to medical product companies seeking data in support of new product introduction, etc., that we would have such a positive response to the offer of providing the data on the top volume hospitals with claim data on the DRG or ICD-9 codes of interest. It was really overwhelming. MMD (MedMarket Diligence) looked at the types of questions being asked, and the purposes being put to the data, by the typical medical product company client -- VP, President, Director, Product manager -- and realized that while on the high end of needs ("what products should we be developing?" or "what companies should we acquire?") the questions were adequately answered by U.S. aggregate data on total volume, with trends, payer segmentation, reimbursement amounts, and the like, but on the "low" end we were not helping clients enough.

By low end, I mean answering questions about "where should I send my sales reps tomorrow?." Well, how about looking at the hospitals in any geographic territory that have the highest volume utilization, measured by patient discharges and the specific diagnoses or procedures currently or potentially using the company's products?

After we started adding this to quotes, we sudddenly realized that hospital-specific data was in very big demand.

There are a lot of other aspects to working with this data, making sense of it and delivering it the right way. In subsequent posts, I'll describe that a little further, but don't have time now.

I have two more quotes to get out before day's end.

Tags: medtech, hospitals, utilization data

Monday, July 17, 2006

Technologies in Treatment of Stress Urinary Incontinence

Bulking Agents for Stress UI

Bulking Agents for Stress UIOne important weapon in the arsenal of noninvasive or minimally invasive therapies for Stress Urinary Incontinence (SUI) comprises bulking agents—injectable substances that expand the intrinsic sphincter of the bladder, allowing it to withstand greater pressures.

There are several companies exploring or developing bulking agents for SUI (see chart). For many of these, the technology was initially designed as a therapy for treatment of wrinkles or other dermal defects, gastroesophageal reflux disease (GERD), wound care, drug delivery or other therapy.Treatment for urinary incontinence ranges from pelvic muscle rehabilitation to behavioral therapies and pharmacologic therapies. Beyond that, surgical therapies exist and are becoming increasingly less invasive. Minimally or even noninvasive interventional therapies are extremely attractive to both young and old patients; younger patients don’t want to be slowed down by an open surgery while many older patients may not be strong enough to undergo such.

The latest therapies being developed to treat SUI involve bulking agents, sling or urethral supports, and even stem cell therapies, among other procedures.At least 13 million Americans suffer from urinary incontinence, a condition that is far more frequent in women than in men. In the general population between the ages of 15 and 64, 10%–30% of women are affected, compared to only 1.5–5% of men. At least 50% of all nursing home residents have urinary incontinence, 70% of whom are women.

The Agency for Health Care Policy & Research estimates that $16.4 billion is spent annually on incontinence-related care: $11.2 billion for community-based programs and at home, and $5.2 billion in long-term care facilities. In addition, $1.1 billion is spent annually on disposable products for adults.See MedMarkets, July 2006 issue.Tags: medtech, incontinence, implant

Monday, July 10, 2006

Spine Surgery Market Development at a Pivotal Stage

[See also "Spine Surgery Worldwide, 2008-2017." Published March 2008. See link.]

Coverage in the July 2006 issue of MedMarkets includes an overview of the U.S. and worldwide spine surgery market (excerpt below).

Treatments for disorders of the spine – ranging from degenerative disc disease, kyphosis, diskitis, spinal stenosis, spondylolysis/spondylolisthesis and others – stand at a crux between multiple options. Spinal fusion (lumbar and cervical) will be on the rise for a few short years before disc replacement/repair and other approaches will have begun to penetrate significant caseload. Competitors in the market for spine surgery products face a combination of opportunity and risk that will result in big rewards for some and only brief rewards for others.

Source: MedMarket Diligence, LLC, Report #M501, "Worldwide Spine Surgery Market." Note: This report has been updated, January 2008, with report #M510, "Spine Surgery Worldwide, 2008-2017." See link.

Treatments for these disorders range from the non-surgical and inexpensive (bed rest) to complicated surgeries designed to excise tissue and halt vertebral segment motion (spinal fusion). “Back trouble”—especially among aging baby boomers and the elderly—is in no imminent danger of decline. Consequently, the spine-related osteobiologics market in the U.S. will undergo steady growth for the next decade. Although certain treatments and technologies currently enjoying a robust market share will likely be replaced by those now in development, older men and women will seek the best treatment alternatives available to help them maintain an active lifestyle.

Over the past two decades, the worldwide spine industry has grown dramatically, with annual revenues in 2004 estimated at about $3.4 billion. Disorders or conditions located in the lumbar area of the spine account for the majority of these revenues.

Tags: medtech, spine, orthopedic

Tuesday, July 04, 2006

Timescale of nanotechnology materials/components and application development

Source: MedMarket Diligence, LLC, from "Micro- and Nanomedicine: Technologies, Applications, Industry, and Markets Worldwide," report #T625. Published May 2006.

Source: MedMarket Diligence, LLC, from "Micro- and Nanomedicine: Technologies, Applications, Industry, and Markets Worldwide," report #T625. Published May 2006.Tags: nanotechnology, nanotech, mems, nanomedicine

Monday, July 03, 2006

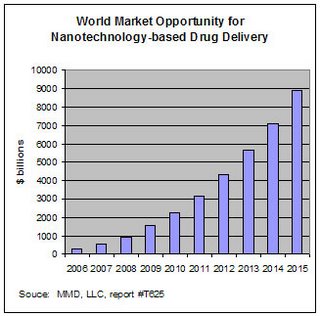

Drug delivery and nanotech

Nanotech products are being developed to improve delivery of drugs with poor solubility. It is estimated that 40-50% of newly developed drugs have solubility problems. Sales of drugs with poor solubility and low bioavailability totalled $72 billion in 2003, up from $64 billion in 2002. The total world market opportunity for nanotech-derived drug delivery products and services was estimated at $290 million in 2005 (0.6% of the total drug delivery market, valued at more than $43 billion). This is predicted to grow at a CAGR of 50% to reach $8.8 billion by 2015, or over 5% of the total drug delivery market.

Nanotech products are being developed to improve delivery of drugs with poor solubility. It is estimated that 40-50% of newly developed drugs have solubility problems. Sales of drugs with poor solubility and low bioavailability totalled $72 billion in 2003, up from $64 billion in 2002. The total world market opportunity for nanotech-derived drug delivery products and services was estimated at $290 million in 2005 (0.6% of the total drug delivery market, valued at more than $43 billion). This is predicted to grow at a CAGR of 50% to reach $8.8 billion by 2015, or over 5% of the total drug delivery market.Many nanotech research projects are devoted to improving drug delivery and targetting in cancer. The oppurtunity is considerable. The total cancer chemotherapy market in 2005 was estimated at $10 billion, including plain and DDS (drug delivery system) products. The DDS market share was 20% in 2000; this is forecast to grow to 80% by 2010. The cancer market itself will grow as the over-65 population in developed countries increase from 12% in 2000 to 20% in 2020.

From MMD's May 2006 report, Micro- and Nanomedicine.

Tags: nanotech, nanotechnology, drug delivery, medtech, cancer