Refractive surgery is performed using a number of surgical techniques, each designed to minimize the patient’s dependence on eyeglasses and contact lenses. Although there are many options to improve refractive error making it a complex field for the surgeon, while at the same time offering a broad range of options to treat each patient’s unique needs, some approaches will grow at a greater rate while other refractive surgery options will be cannibalized by these faster growing techniques or they will be relegated to serving the needs of niche populations. For those techniques that serve a particular niche population, manufacturers will struggle with how to maintain visibility for these sub-population therapies while ensuring that clinical competence will be maintained at a level to allow the surgeon to deliver the outcomes that are feasible.

Numerous factors come into play as the market for refractive surgery evolves:

- Clinical Outcomes – documented clinical advantage will not only encourage physicians to embrace new approaches to refractive surgery, it will help clinicians to determine the subset of patients that are most likely to benefit by one technique over another.

- Physician Education – the speed with which surgeons can be trained on the new techniques

- Access – how rapidly will the market adopt the technology that is necessary to perform the procedure and how quickly will the market be penetrated

- Patient Education – the ability of physicians and marketing efforts by manufacturers to inform patients of various options

- Cost – Significant differences in price to the patient as well as cost associated with training and equipment by physicians and ambulatory care centers

- Reimbursement – insurers willingness to pay for such procedures will continue to be a factor in a patient’s decision to undergo refractive surgery

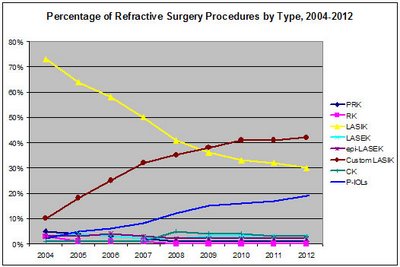

The net effect is that custom LASIK will soon constitute a dominant share of refractive procedures.

Globally, the U.S. dominates the market for refractive surgery products, but strong growth is evident in many countries.

Tags: medtech, ophthalmology, refractive, LASIK