Thursday, December 07, 2006

FDA Panel Assesses Drug-Eluting Stents and Clotting

Principal players (with a bevy of newcomers waiting in the wings) Boston Scientific and Johnson & Johnson have different spins on the risk. Boston Scientific "acknowledges a slight increase in clotting associated with its drug-coated stent, the Taxus," but the company asserts that there is no corresponding increased risk of heart attack or death. Johnson & Johnson argues that the risk of clotting, heart attack or death is equivalent for drug-eluting and bare stents.

The question of increased risk of clotting will certainly influence approvals of pending drug-eluting stents from Medtronic, Abbott and others.

Detailed coverage of the drug-eluting stent market is provided in the October 2006 issue of MedMarkets (subscribers).

Tags: medtech, stents

Wednesday, December 06, 2006

Orthopedic Biomaterials Global Market

Orthopaedic devices are a major contributor to the global medical device market, accounting for almost $26 billion in 2006, and with a growth rate that reflects growth in the medical sector overall. The table below gives a market growth projection for the five years 2007-2011.

| | Worldwide Sales | Growth |

| 2006 | 25,764 | -- |

| 2007 | 27,122 | 5.3% |

| 2008 | 28,562 | 5.3% |

| 2009 | 30,989 | 8.5% |

| 2010 | 31,708 | 2.3% |

| 2011 | 33,425 | 5.4% |

| CAGR | 5.3% | |

Orthopaedic Biomaterials

The current valuation of the orthopaedic biomaterials segment is around $5 billion, representing over 17% of the orthopaedic total. It is also estimated that this market segment will grow at 10-12% a year, that is more than double the rate for the overall orthopaedics market. At this rate the biomaterials segment will achieve a value of $9.5 billion by 2011 and will represent 28% of all orthopaedic product sales.

The global market for orthopedic biomaterials is analyzed in a new report from MedMarket Diligence (www.mediligence.com).

Tags: medtech, orthopedic

Thursday, November 30, 2006

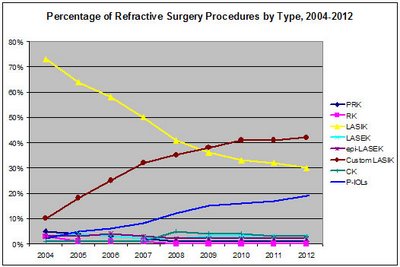

Global Growth in Refractive Surgery

Refractive surgery is performed using a number of surgical techniques, each designed to minimize the patient’s dependence on eyeglasses and contact lenses. Although there are many options to improve refractive error making it a complex field for the surgeon, while at the same time offering a broad range of options to treat each patient’s unique needs, some approaches will grow at a greater rate while other refractive surgery options will be cannibalized by these faster growing techniques or they will be relegated to serving the needs of niche populations. For those techniques that serve a particular niche population, manufacturers will struggle with how to maintain visibility for these sub-population therapies while ensuring that clinical competence will be maintained at a level to allow the surgeon to deliver the outcomes that are feasible.

Numerous factors come into play as the market for refractive surgery evolves:

- Clinical Outcomes – documented clinical advantage will not only encourage physicians to embrace new approaches to refractive surgery, it will help clinicians to determine the subset of patients that are most likely to benefit by one technique over another.

- Physician Education – the speed with which surgeons can be trained on the new techniques

- Access – how rapidly will the market adopt the technology that is necessary to perform the procedure and how quickly will the market be penetrated

- Patient Education – the ability of physicians and marketing efforts by manufacturers to inform patients of various options

- Cost – Significant differences in price to the patient as well as cost associated with training and equipment by physicians and ambulatory care centers

- Reimbursement – insurers willingness to pay for such procedures will continue to be a factor in a patient’s decision to undergo refractive surgery

The net effect is that custom LASIK will soon constitute a dominant share of refractive procedures.

Globally, the U.S. dominates the market for refractive surgery products, but strong growth is evident in many countries.

Tags: medtech, ophthalmology, refractive, LASIK

Wednesday, November 29, 2006

Orthopedic Biomaterials Market Segment Growth

The worldwide market for orthopedic biomaterials -- allografts, synthetic bone substitutes, bone growth factors, polymers, ceramics, etc. -- is growing steadily due to a concurrent evolution of surgical procedures, the emergence of innovative products and a dynamic and growing patient population. Select segment growth in this worldwide market is shown at right.

Data drawn from forthcoming MedMarket Diligence report, "Emerging Trends, Technologies and Opportunities in the Markets for Orthopedic Biomaterials, Worldwide." (publishing Nov/Dec 2006)

Tags: medtech, orthopedic, biomaterial

Saturday, November 04, 2006

Drug-Eluting and Bioabsorbable Stents

>> See updated coverage of drug-eluting and bioabsorble stents on the current blog at mediligence.com/blog.

From October 2006 MedMarkets

| Company | Stent | Drug | Status |

| Abbott Vascular | BVS (bioabsorbable) | Everolimus | ABSORB first-in-man clinicals began 3/06 |

| Xience V (distributed by Boston Scientific as Promus) | Everolimus | CE Mark 1/06; European launch 10/06; U.S. launch expected 2008 | |

| ZoMaxx | Zotarolimus | Development discontinued 10/06 | |

| Avantec Vascular | Duraflex | Pimecrolimus | In development |

| Beijing Lepu Medical Device | Ton Xin Partner | Sirolimus | Launched in China 11/05 |

| Biosensors International | Axxion | Paclitaxel | CE Mark 7/05 |

| BioMatrix | Biolimus A9 | In trials; expects CE Mark in 2006 | |

| Biotronik | Absorbable Metal Stent (AMS) | Completely bioabsorbable magnesium alloy | In clinicals (PROGRESS) |

| Blue Medical Devices | Melissa | Melatonin | In clinicals (NOBLESSE) |

| Boston Scientific | Taxus Express2 | Paclitaxel | CE Mark 1/03; FDA approval 3/04 |

| Taxus Liberté | Paclitaxel | CE Mark 9/05; FDA approval expected 2006 | |

| Conor Medsystems | Corio | Pimecrolimus | GENESIS trial began 5/06 |

| CoStar | Paclitaxel | CE Marked 2/06; U.S. launch expected 2007/2008 | |

| CoStar II (bioabsorbable polymer) | Paclitaxel | In clinicals | |

| SymBio | Pimecrolimus and paclitaxel | GENESIS trial began 5/06 | |

| Cordis (J&J) | Cypher | Sirolimus | CE Mark; FDA approved; U.S. launch 4/03 |

| Cypher Neo (for smaller arteries) | Sirolimus | U.S. launch expected 2007 | |

| Cypher Select | Sirolimus | CE Mark in 2003 | |

| Cypher Select Plus | Sirolimus | International launch (outside U.S., Japan) 9/06 | |

| CorNova | Chronoflex DES | (Undisclosed) | In development |

| Devax | Axxess (bifurcated) | Biollimus A9 | Clinicals (DIVERGE) began 6/06 |

| DISA Vascular | Stellium | Paclitaxel | Clinicals to begin 2007 |

| Endovasc-TissueGen | (Undisclosed; fully resorbable) | Prostaglandin E-1 antirestenotic | In development |

| Estracure | (Undisclosed) | 17-(beta)-estradiol | In clinicals |

| JW Medical Systems | Excel (bioabsorbable) | Rapamycin | U.S. Phase IV clinicals began 6/06 |

| Medtronic | Endeavor | Zotarolimus | CE Mark 7/05; U.S. launch planned 2007 |

| MicroPort Medical | Firebird (cobalt alloy polymer) | Sirolimus | Approved in China 2003 |

| MIV Therapeutics | (Undisclosed) | (Undisclosed) | Vascore Medical (acquisition agreement announced 9/06) stents to carry MIVT coatings |

| OrbusNeich | Cura (bioabsorbable polymer) | Sirolimus | In clinicals (Singapore) |

| Genous Bio-engineered R Stent (bioabsorbable) | Coated with antibody that captures patient’s own endothelial progenitor cells | CE Mark 8/05; HEALING III trials began 2006, 9-mo. results expected 1Q07 | |

| Relisys Medical Devices | (Undisclosed) | Paclitaxel | In clinicals |

| REVA Medical | REVA Medical Resorbable Stent | Balloon-expandable, drug-eluting polymer | First-in-man trials to begin 2006 |

| Sahajanand Medical Technologies | Infinnium | Paclitaxel | CE Mark 12/05 |

| Infinnium Bioabsorbable | Paclitaxel | In clinicals (SIMPLE registries) | |

| Supralimus (bioabsorbable) | Sirolimus | In clinicals (SERIES) | |

| Sorin Biomedica Cardio | Janus Flex | Tacrolimus | CE Mark; launched in Europe 2/06 |

| Terumo | Nobori | Biolimus A9 | Clinicals began 6/05; product launch expected late 2006 |

| Translumina | Yukon ChoiceDES (polymer-free) | Rapamycin | International launch 4/06 |

| Vascular Concepts | ProNova | Sirolimus | Available internationally |

| X-Cell Medical | Ethos | 17-(beta)-estradiol | In clinicals (ETHOS); to incorporate SurModics’ Bravo polymer matrix per 9/06 licensing agreement |

| Xtent | Custom NX | Biolimus A9 | In clinicals; European launch expected 2007, U.S. in 2009 |

| Source: MedMarket Diligence, LLC | |||

Tags: medtech , stents , drug-eluting

Subscribe online to MedMarkets

Wednesday, October 25, 2006

Can We Handle the Pace of Technology Development?

From time to time, when I am looking at current developments to gauge the future of medical technology markets, certain common threads seem to be seen suggesting a theme, if not a legitimate trend, encompassing them all. Each of the developments may be noteworthy on their own, but if part of an overall trend, the developments become supportive evidence.

Explosive New Technology

The emergence of evidence that drug-eluting stents correlate to some significant degree with increased risk of late-stage restenosis demonstrated that the technology that suddenly produced at $5 billion market for J&J, Boston Scientific and now others (see "Drug-Eluting Stents Vie for Market Share With Innovation, Acquisitions" in this issue, page 1) was not as perfect as cardiologists (or investors) would have hoped. One might be inclined to grant a little forgiveness on the part of both manufacturers and clinicians in their zeal for the new technology, given the incontrovertible data on the restenosis associated with bare metal stents and the overwhelmingly positive short term data that drug-eluting stents dramatically reduce restenosis. But the zeal did extend beyond the direct clinical benefit of anti-restenosis. It extended to the support for a huge medical device market—encompassing angioplasty and stents—that was arguably at risk of renewed competition by coronary artery bypass grafting, which has seen device market development of its own (beating heart bypass, percutaneous technologies, even robotics) to retake the market for treatment of coronary artery disease. Neither patients seeking better outcomes, nor clinicians seeking secured caseload, nor manufacturers seeking increased revenue had particular incentive to challenge the long-term outcomes of drug-eluting stents. Those who did raise such yellow flags were not well received.

Business Week Online (Science & Technology, October 9, 2006) noted the case of Dr. Renu Virmani of the cvpath Institute (Gaithersburg, MD) who, at a meeting in Paris in 2004, tried to inject a level of restraint in the enthusiasm for drug-eluting stents. She believed, based more on (what turned out to be valid) instinct than on a large body of hard clinical data, that the drugs used to prevent restenosis would in fact only delay restenosis or lead to other problems, such as clots. By all accounts, her message was not well received. Now, with the benefit of hindsight and hard clinical data, even clinicians and manufacturers are acknowledging the higher risk of blood clots associated with drug-eluting stents. However, one can't help but feel the implicit tendency among all stakeholders to minimize the significance of this increased risk while noting, of course, that more data needs to be collected.

We can go out on a relatively short limb here and assert that virtually every new technology will be overused in the short run. For medical technologies, the primary limiter is contraindication, and until a sufficient body of clinical data is produced to flesh out the contraindicated population, there will be little limitation in a new technology's growth. The alternative is untenable, that a new technology not be approved until such volume of data is produced by numbers of cases and long term follow up to fully elucidate all the risks. The FDA, of course, would be the remaining voice for restraint, but its voice is virtually drowned out by clinicians, manufacturers and patients who clamor for the new technology.

Radically New Technology

In a recent report issued by the Woodrow Wilson Center's Project on Emerging Nanotechnologies, Michael Taylor, former deputy commissioner for policy at the FDA and now a professor at the University of Maryland, notes that the FDA is severely constrained by budget limitations such that it is wholly ill-prepared to regulate nanotechnologies. Taylor notes that, with upwards of 320 products with nanomaterials already on the market, and with over 200 drugs and medical devices incorporating nanotechnology in the pipeline, the FDA needs to be authorized by Congress to collect more safety data and perform more post-marketing surveillance. Moreover, the agency simply needs more funding to hire staff and develop expertise that is as good or better than the nanotech industry that it will be expected to police.

Nanotechnology is a radically new technology or, rather, technologies. The definition of nanotechnology, framed as it is simply by the size the of products (or their components), lends itself to an incredibly diverse set of technologies (see past MedMarkets issues //Dona??//) that will exceed FDA’s abilities to address safety and efficacy. By some estimates, the U.S. government has already invested $1.3 billion in nanotechnology initiatives and private industry has added another $1.7 billion, as testament to the benefits that are expected to emerge. If, as was already noted, the FDA had limited ability to provide effective restraint in the growth of drug-eluting stents, a market for which it arguably already has adequate expertise, then what might one expect for nanotechnology?

The examples of drug-eluting stents and nanotechnologies centered on limitations with the FDA in constraining the emergence of technologies to protect patients, and while regulation of medical technologies by the FDA must certainly become more effective (read, more aggressive) to accompany the aggressive development of medical technologies, the best regulation of medical technologies cannot occur without the effective management of the downside of medical technologies by manufacturers themselves. The recent history of manufacturers not taking the long view of their products (e.g., Guidant, Merck) is evidence enough for products that aren’t characterized by rapidly growing or radically new technologies. The range, types and potential impact of new technologies poised to enter the marketplace (i.e., beyond nanotechnologies) is truly breathtaking and without some level of judicious restraint applied to the pace of their introduction, the past examples of repercussions from technologies too aggressively introduced will pale in comparison.

Tags: medtech, FDA, nanotechnology, stents

Thursday, October 05, 2006

Technologies and that Highlight Advances and Precipate Even More

September 2006

MedMarket Outlook: Technologies that Highlight Advances and Precipitate Even More

Product developments with the potential to dramatically alter the landscape of both patient care and manufacturer market shares are numerous. They take many forms, from pure device, biotech or pharmaceutical to endless combinations of them all. Device technologies also represent a unique platform for health care delivery beyond simple device, drug-coated or other device hybrids.

In any industry, there are many wildcard technologies --- innovations envisioned to enable radical solutions to problems, thereby turning current markets on their heads. The medical technology industry is not only no exception, but is as good an example of this as any. Here we consider examples for illustration:

Implantable Wireless Biosensors

The University of Rochester Medical Center and an associated startup (Physiologic Communications LLC) is working on producing implantable wireless biosensors that will be integrated with living cells in order to detect and report on localized physiologic and chemical changes. Moving beyond the idea of implantable miniature drug delivery chips (e.g., MicroCHIPS), these devices will be hybrids of devices and cells such that the cells remain viable as a component of a miniature electronic chip. Localized physiologic conditions can be monitored -- the presence of specific proteins, ion concentrations or changes -- or in the technology's more advanced potential therapeutics can be delivered directly or the biosensor can trigger delivery by other localized devices (e.g., a defibrillator or pacemaker). The devices also hold potential for in vitro drug testing in order to test new drug candidates prior to animal or human trials.

The ability to integrate devices with biologics and, indeed, viable cells has profound implications for technology development, particularly because the end result of doing so is to compensate for some of the inherent limitations of medical devices:

- Medical technology is eminently invasive. Just as laparoscopy was a radical improvement over traditional open surgery due to its ability to greatly reduce invasiveness, the advent of implantable technologies, which might ultimately be implanted via catheter, syringe or other relatively non-invasive techniques, if only for diagnostic or monitoring purposes, harbors the potential to similarly reduce the invasiveness of medical technologies.

- Medical technology, and devices in particular, is an arm's length proposition. Once a medical device is implanted, it is largely hidden. If the device can be revealed real-time by integrating sensors with cells as well as the device itself, then the resulting knowledge by the clinician (and the manufacturer) can enable multiple improvements in the device's performance. This would include optimizing placement of the device during implantation (e.g., to augment fluoroscopic guidance), alerting to changes in status of the device or the device's environment to alert the clinician to impending device failure, change in patient status requiring intervention or other local changes.

- Medical technology is symptom-oriented. Medical devices are innately crude -- this is not to detract from their sophistication of design, but metal, polymer or even more advanced material construction is frequently designed to, at best, minimize inflammation or other clinical sequellae. Understanding the nature of the device’s environment with which it actively or passively interacts is paramount to improving device performance.

The erosion of the differences between devices, drugs and biologics is furthered by advances of those described above. Wireless, living cell biosensors may soon have the capacity to be "aware of" and respond to local physiologic conditions by administering therapeutics or other intervention.

Non-invasiveness versus Minimal Invasiveness

Despite the best intentions of drugs, biotech and medical devices, it frequently becomes necessary to intervene with a surgical solution. Laparoscopy and thoracoscopy have already demonstrated that surgery can be made drastically less invasive. However, even the minimal invasiveness of "keyhole" surgery is still invasive and can therefore be improved upon.

Minos Medical (

Minos Medical's Appendoectomy is one of several procedures being developed in surgical endoscopy under the heading, "Natural Orifice Transluminal Endoscopic Surgery" or "NOTES". Minos is also developing procedures for cholecystectomy and hysterectomy, two other high volume surgeries.

Given the number of diseases in the gastrointestinal tract, NOTES represents a formidable potential for the continued evolution of surgery away from invasiveness.

Analogously, cardiovascular applications are similarly evolving away from invasive surgical procedures such as traditional coronary artery bypass graft (CABG) to percutaneous interventional procedures and even to percutaneous CABG (originally developed by TransVascular, Inc., acquired in 2003 by Medtronic).

The balance of care is shifting away from traditional surgery toward laparoscopic, endoscopic and percutaneous procedures, a trend driven by innovations that enable procedures to be done less invasively or non-invasively and with competitive outcomes. Healthcare is thereby shifting away from surgeons and toward gastroenterologists, interventional cardiologists and other non-surgical specialists, a fact enabled by and of great interest to manufacturers.

Ultimately, however, true non-invasiveness is an achievement that may well not be possible with any type of medical technology at all, but only with orally, nasally, topically or other non-syringe administered drugs.

Removing the veil

Gaining a more intimate picture of structures and processes at the cellular level and below is another advance that will augment the ability of health care to understand and intervene. In September, Nikon Corporation held its "Small World" international light microscopy photo competition, with this year’s winning image of the nuclei of a mouse colon cells, a picture taken by Dr. Paul Appleton, of the University of Dundee (UK). The picture was selected due to its originality, visual impact and, in particular, its informational content, which was that it was judged to help elucidate regulation of cellular changes and their involvement in the development of colon cancer.

The inability to directly see processes at the cellular and molecular levels has been, in some ways, the catalyst for truly innovative experiments that elucidate structure, function, dynamics, causality and other answers in medical science. But, with so many advances in imaging technology (X-ray, MRI, SPECT, etc.), combined with increased understanding (from other technologies) of the nature of cellular and molecular processes, a multitude of discoveries must be pending in medical science that will remove the veil from healthy and pathological processes and open the doors to treatments -- drug, biotech, device and others -- that we have not yet envisioned.

We have highlighted in past MMO columns that discoveries in medical sciences and advances in the development of more effective treatments are increasingly coming as a result of synergy gained between multiple scientific disciplines, as well as through the contribution of information technologies that can reveal what is significant, even when we are not looking for it. But it is the aggressive development of seemingly unrelated innovations that not only produces new treatments -- even cures -- but also furthers the trend toward more and greater advances.

URLs

Medtronic, Inc. -- Minneapolis, MN; http://medtronic.com

Minos Medical, Inc. -- Irvine, CA; http://minosmedical.com

Physiologic Communications, Inc. -- Rochester, NY; http://physiocomm.com (under construction)

Tags: medtech, medical technology

Tuesday, September 26, 2006

Startup Medtech Companies, September 2006

| Company | Principal(s) | Location | Product/Technology | Founded |

| AcelRx | Thomas A. Schreck | Portola Valley, CA | Drug-device technology for treatment of breakthrough pain | 2006 |

| Amaranth Medical, Inc. | Guy Heathers, Charter Life Sciences | E. Palo Alto, CA | Bioresorbable drug-eluting stents | 2006 |

| Arbel Medical Ltd. | Didier Toubia, CEO | Yoknean, Israel | Cryosurgical ablation technology | 2006 |

| CardioInsight Technologies, Inc | Warren Goldenberg, CEO | Cleveland, OH | Electrocardiographic imaging of the heart's electrical activity | 2006 |

| Minos Medical, Inc. | Bradley J. Sharp, CEO | Irvine, CA | Minimally invasive (HIFU) surgical systems for appendectomy, cholecystectomy and hysterectomy | 2006 |

| nContact Surgical, Inc. | John P. Funkhouser, President & CEO | Morrisville, NC | Intraoperative tissue coagulation devices | 2005 |

| OmniMedics, Inc. | Alan Cohen | Newton, MA | Cardiac device | 2006 |

| Sirion Therapeutics, Inc. | Philippe Boulangeat, Chief Business Officer | Tampa, FL | Therapeutic ophthalmology compounds and other products | 2006 |

Amaranth Medical, Inc. (East Palo Alto, CA; no URL)

Arbel Medical Ltd. (Yoknean, Israel; http://arbel-medical.com [under construction])

CardioInsight Technologies, Inc. (Cleveland, OH; http://cardioinsight.com)

Minos Medical, Inc. (Irvine, CA; http://minosmedical.com)

nContact Surgical, Inc. (Morrisville, NC; http://ncontact.us)

OminiMedics, Inc. (Newton, MA; http://omnimedics.com)

Sirion Therapeutics, Inc. (Tampa, FL; http://siriontherapeutics.com)

Friday, September 08, 2006

U.S. diabetes prevalence to double by 2050

diabetes (link). Moreover, if the rate of diabetes in the U.S. population continues to rise, the prevalance by 2050 will be even higher.

Further, the rates of growth in prevalence will be disparate. Minorities will face a significant added burden, with prevalence among whites doubling by 2050, while the prevalence among African-Americans will triple and the number of Hispanics with diabetes will increase almost six-fold. Diabetics aged 65-74 will triple and those over 75 will increase five-fold.

Given the associated costs of diabetes and its complications, this data adds to a steady chorus of support among clinicians for better screening, diagnosis and management of diabetes.

Tags: medtech, diabetes, insulin, glucose

Wednesday, September 06, 2006

Bioengieering the end of medical devices (well, eventually)

Bioengineering could replace pacemakers. In the September 5 article of Circulation, it was shown that delivery of a bioengineered cell-surface protein to the cardiac tissue of pigs could effectively regenerate the sinoatrial (SA) node, the principal site for controlling heart rhythm.

Discovery of new gene that stimulates the growth of natural bypasses. Researchers at the Max-Planck Institute for Heart and Lung Research in Germany identified a gene responsible for inducing the formation of collateral vessels, which bypass blocked arteries. Further, researchers were able to demonstrate an ability to enhance the growth of the collateral vessels, or "natural bypasses", in order to improve the results of surgical interventions or, perhaps one day, preempting surgery entirely.

The heart can heal itself. Additionally reported at the World Congress of Cardiology in September, it has been discovered that mammalian hearts possess a reservoir of stem cells that contribute to the formation of new vessels and myocytes during the course of the organism's lifespan and that, further, it may ultimately be possible "to induce the stem cells residing in the heart to migrate to the sites of damage forming new vessels and myocytes."

Hammering away as I do on my theme that discoveries in the biological sciences hold eminent potential to preempt the symptoms-oriented treatment provided by devices, but that biotech inevitably underestimates the developmental hurdles in doing so, it is clear that the potential offered up here in bioengineering cardiac tissue is very likely as understated as are the challenges.

Tags: medtech, biotech, bioengineering

Thursday, August 24, 2006

The Intellectual Property Yardstick

Out of curiosity, since I see Medtronic so frequently on patents and patent applications, I decided to take a one month snapshot, from July 25 to August 24 (today) of patent applications referencing the phrase "medical device" and examine it for the patent assignee company or other company reference. Here's what came out:

Medtronic's dominance (38 patents for medical devices in one month) of the intellectual property game is pretty astounding. It begs the question of how a player can hope to dominate the market without having some technological advantage, and whether pursuing a campaign of patent strength will correlate with success in the market.

These are just questions.

Wednesday, August 23, 2006

Medtech analysis test drive

The xml link is here.

Tags: medtech

Tuesday, August 22, 2006

Energy-Based Devices in General Surgery

The dynamic market for energy-based devices used in general surgery is growing steadily with compounded annual growth rates of 12% projected for the short term. This market includes devices based on ultrasonic, radio frequency (RF), light, thermal, hydromechanical, cryogenic and microwave technologies.

The popularity of ultrasonic devices is due in large part to the fact that they do not utilize heat when sealing tissues, thus effectively eliminating smoke from the operating room. This can reduce costs for hospitals as the absence of smoke eliminates the need for smoke evacuation systems. Meanwhile, the lack of smoke also improves the surgeon’s line of vision. Also to their benefit, ultrasonic surgical instruments combine cutting, grasping and coagulation into one tool set, thus further reducing cost while also reducing surgical time as there is no longer a need for intraoperative instrument exchanges. Lastly, patient safety is enhanced because with ultrasonic systems, there is no electric current passing though the patient’s body, which can result in lateral tissue damage.

The second largest segment in the market for energy-based devices used in general surgery comprises devices based on RF energy, which (like laser systems) rely on thermal welding to achieve tissue coagulation. RF devices comprise roughly 27% of the overall market for devices used in general surgery. Growth in this market segment is being driven by the introduction of new technologies into the marketplace.

Thermal energies, which are used most often in surgeries to treat benign prostatic hyperplasia (BPH) and menorrhagia, also have application in general surgery, however, less than 5% of the market is devoted to these systems. Newly developed hydromechanical (based on water-jet technology), cryogenic, and microwave systems also are being introduced into the market, thus further fueling market growth in devices designed for general surgery.

(Further details in August 2006 MedMarkets.)

Wednesday, August 16, 2006

August 2006 startup medtech companies

Andrew Tehnologies, Inc. -- Haddonfield, NJ; http://andewtechnologies.com [under contruction]

Nitric BioTherapeutics, Inc. -- Brisol, PA; no URl

Recovery Science, LLC -- Hollywood, MD; no URL

SurgiQuest, Inc. -- Fairfield, CT; no URL

Source: MedMarkets, August 2006, MedMarket Diligence, LLC

Monday, August 14, 2006

Biomaterials Stimulating Orthpedic Growth

The total world market for all orthopedic devices and materials was worth $20 billion in 2005 and is growing at annual rates in the range 7-10%; the US accounts for almost half the market overall. A major contributor to the market, both in terms of size and growth, is orthopaedic biomaterials. This segment contributed $4.6 billion (23%) to the global orthopaedic market in 2005 and furthermore is growing considerably faster than the market overall, with a predicted CAGR in the region of 15% over the next five years. The buoyant performance of this sector is due to a combination of several factors, including demographic and lifestyle changes, the emergence of new types of biomaterials offering significant improvements in performance, the premium prices associated with novel high-tech products, and evolving attitudes among orthopaedic surgeons.

From August 2006 issue of MedMarkets and forthcoming MedMarket Diligence report #M625.

Tags: medtech, orthopedic, biomaterials

Tuesday, July 25, 2006

Artificial Pancreas for Diabetes: The Closed Loop Pump/Monitor

At the 66th Scientific Sessions of the annual American Diabetes Association meeting, there was considerable focus on efforts to develop the artificial pancreas. Rather than summarize those efforts myself, I instead provide this excellent review by Andrew B. Muir, MD, on Medscape.

The possibility remains for stem cell research to enable pancreatic cell transplant or similar cell based therapies, since the restriction on federal funding is regressive but destined to succumb to more enlightened consideration of the issue -- science and ethics -- than is possible with the current administration.

Tags: medtech, diabetes, glucose

Wednesday, July 19, 2006

Local Market Volume of Medical/Surgical Procedures

As I mentioned, the Medicare 100% file is large (measured in gigabytes) unwieldy and, as anyone who has purchased raw data from the U.S. government can attest, the file is not constructed in the most convenient format to allow simply queries, summaries or other processes that will reveal meaninful insights. And, given the cost, the need for HIPAA-related disclosure agreements to be signed,m the dataset is not quite amenable to data analyst with occasional interest or need in purusing it. Lastly -- and this goes for all reimbursement or discharge survey datasets -- whatever logic may govern the coding systems (DRG, ICD-9 and CPT4) used in this data, the reality of how clinicians fle claims and how survey data is collected can result requires that working with claims-based and survey-based datasets be done by someone with experience in these issues.

Now you might understand why the question, "So if this is in the public domain, how is your product in any way unique?" causes me to take a breath before answering.

MMD has joined with Medical Technology Partners (MTP) to capitalize on MTP's use of these large datasets, which have been acquired for reimbursement consulting, to use them for answerng very technology-specific and facility-specific questions raised by medical product manufacturers.

Tags: medtech, hospitals, utilization data

Tuesday, July 18, 2006

Top Volume Hospitals by DRG, ICD-9

We had no idea when we started offering clinical utilization data to medical product companies seeking data in support of new product introduction, etc., that we would have such a positive response to the offer of providing the data on the top volume hospitals with claim data on the DRG or ICD-9 codes of interest. It was really overwhelming. MMD (MedMarket Diligence) looked at the types of questions being asked, and the purposes being put to the data, by the typical medical product company client -- VP, President, Director, Product manager -- and realized that while on the high end of needs ("what products should we be developing?" or "what companies should we acquire?") the questions were adequately answered by U.S. aggregate data on total volume, with trends, payer segmentation, reimbursement amounts, and the like, but on the "low" end we were not helping clients enough.

By low end, I mean answering questions about "where should I send my sales reps tomorrow?." Well, how about looking at the hospitals in any geographic territory that have the highest volume utilization, measured by patient discharges and the specific diagnoses or procedures currently or potentially using the company's products?

After we started adding this to quotes, we sudddenly realized that hospital-specific data was in very big demand.

There are a lot of other aspects to working with this data, making sense of it and delivering it the right way. In subsequent posts, I'll describe that a little further, but don't have time now.

I have two more quotes to get out before day's end.

Tags: medtech, hospitals, utilization data

Monday, July 17, 2006

Technologies in Treatment of Stress Urinary Incontinence

Bulking Agents for Stress UI

Bulking Agents for Stress UIOne important weapon in the arsenal of noninvasive or minimally invasive therapies for Stress Urinary Incontinence (SUI) comprises bulking agents—injectable substances that expand the intrinsic sphincter of the bladder, allowing it to withstand greater pressures.

There are several companies exploring or developing bulking agents for SUI (see chart). For many of these, the technology was initially designed as a therapy for treatment of wrinkles or other dermal defects, gastroesophageal reflux disease (GERD), wound care, drug delivery or other therapy.Treatment for urinary incontinence ranges from pelvic muscle rehabilitation to behavioral therapies and pharmacologic therapies. Beyond that, surgical therapies exist and are becoming increasingly less invasive. Minimally or even noninvasive interventional therapies are extremely attractive to both young and old patients; younger patients don’t want to be slowed down by an open surgery while many older patients may not be strong enough to undergo such.

The latest therapies being developed to treat SUI involve bulking agents, sling or urethral supports, and even stem cell therapies, among other procedures.At least 13 million Americans suffer from urinary incontinence, a condition that is far more frequent in women than in men. In the general population between the ages of 15 and 64, 10%–30% of women are affected, compared to only 1.5–5% of men. At least 50% of all nursing home residents have urinary incontinence, 70% of whom are women.

The Agency for Health Care Policy & Research estimates that $16.4 billion is spent annually on incontinence-related care: $11.2 billion for community-based programs and at home, and $5.2 billion in long-term care facilities. In addition, $1.1 billion is spent annually on disposable products for adults.See MedMarkets, July 2006 issue.Tags: medtech, incontinence, implant

Monday, July 10, 2006

Spine Surgery Market Development at a Pivotal Stage

[See also "Spine Surgery Worldwide, 2008-2017." Published March 2008. See link.]

Coverage in the July 2006 issue of MedMarkets includes an overview of the U.S. and worldwide spine surgery market (excerpt below).

Treatments for disorders of the spine – ranging from degenerative disc disease, kyphosis, diskitis, spinal stenosis, spondylolysis/spondylolisthesis and others – stand at a crux between multiple options. Spinal fusion (lumbar and cervical) will be on the rise for a few short years before disc replacement/repair and other approaches will have begun to penetrate significant caseload. Competitors in the market for spine surgery products face a combination of opportunity and risk that will result in big rewards for some and only brief rewards for others.

Source: MedMarket Diligence, LLC, Report #M501, "Worldwide Spine Surgery Market." Note: This report has been updated, January 2008, with report #M510, "Spine Surgery Worldwide, 2008-2017." See link.

Treatments for these disorders range from the non-surgical and inexpensive (bed rest) to complicated surgeries designed to excise tissue and halt vertebral segment motion (spinal fusion). “Back trouble”—especially among aging baby boomers and the elderly—is in no imminent danger of decline. Consequently, the spine-related osteobiologics market in the U.S. will undergo steady growth for the next decade. Although certain treatments and technologies currently enjoying a robust market share will likely be replaced by those now in development, older men and women will seek the best treatment alternatives available to help them maintain an active lifestyle.

Over the past two decades, the worldwide spine industry has grown dramatically, with annual revenues in 2004 estimated at about $3.4 billion. Disorders or conditions located in the lumbar area of the spine account for the majority of these revenues.

Tags: medtech, spine, orthopedic

Tuesday, July 04, 2006

Timescale of nanotechnology materials/components and application development

Source: MedMarket Diligence, LLC, from "Micro- and Nanomedicine: Technologies, Applications, Industry, and Markets Worldwide," report #T625. Published May 2006.

Source: MedMarket Diligence, LLC, from "Micro- and Nanomedicine: Technologies, Applications, Industry, and Markets Worldwide," report #T625. Published May 2006.Tags: nanotechnology, nanotech, mems, nanomedicine

Monday, July 03, 2006

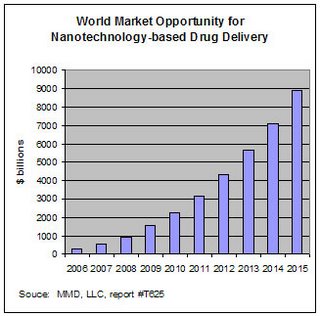

Drug delivery and nanotech

Nanotech products are being developed to improve delivery of drugs with poor solubility. It is estimated that 40-50% of newly developed drugs have solubility problems. Sales of drugs with poor solubility and low bioavailability totalled $72 billion in 2003, up from $64 billion in 2002. The total world market opportunity for nanotech-derived drug delivery products and services was estimated at $290 million in 2005 (0.6% of the total drug delivery market, valued at more than $43 billion). This is predicted to grow at a CAGR of 50% to reach $8.8 billion by 2015, or over 5% of the total drug delivery market.

Nanotech products are being developed to improve delivery of drugs with poor solubility. It is estimated that 40-50% of newly developed drugs have solubility problems. Sales of drugs with poor solubility and low bioavailability totalled $72 billion in 2003, up from $64 billion in 2002. The total world market opportunity for nanotech-derived drug delivery products and services was estimated at $290 million in 2005 (0.6% of the total drug delivery market, valued at more than $43 billion). This is predicted to grow at a CAGR of 50% to reach $8.8 billion by 2015, or over 5% of the total drug delivery market.Many nanotech research projects are devoted to improving drug delivery and targetting in cancer. The oppurtunity is considerable. The total cancer chemotherapy market in 2005 was estimated at $10 billion, including plain and DDS (drug delivery system) products. The DDS market share was 20% in 2000; this is forecast to grow to 80% by 2010. The cancer market itself will grow as the over-65 population in developed countries increase from 12% in 2000 to 20% in 2020.

From MMD's May 2006 report, Micro- and Nanomedicine.

Tags: nanotech, nanotechnology, drug delivery, medtech, cancer

Friday, June 23, 2006

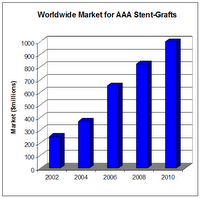

Endovascular Technologies Drive AAA and TAA Stent-Graft Market

Stent-Grafts for AAA will represent a $1 billion market in less than five years.

Stent-Grafts for AAA will represent a $1 billion market in less than five years.Endovascular aortic repair (EVAR) is one of the most significant technological advances in vascular surgery over the last decade and continues to show promise as a less-invasive alternative to conventional surgery in treating patients with abdominal aortic aneurysms (AAAs) or thoracic aortic aneurysms (TAAs). As manufacturers make ongoing refinements to endovascular devices for aneurysm therapy, the estimated 2.7 million aortic aneurysm patients in the United States have more treatment options available than ever before. Although aneurysms are far less common than heart attacks, they are also far more fatal. According to the National Center for Health Statistics, roughly 15,000 patients die annually from ruptured aortic aneurysm, and this number may be low because the condition can be overlooked easily in a standard autopsy. Ruptured abdominal aneurysm is currently the 13th leading cause of death in the United States. In fact, as many as 2 of 3 patients with an AAA rupture die prior to reaching the hospital. Even with open surgery, there is an average 48% mortality rate associated with patients having a ruptured AAA. AAAs typically enlarge slowly and without symptoms, making them difficult to detect. However, detecting AAAs early and repairing them can decrease the death rate by one-sixth. TAAs are also under-diagnosed because most patients are asymptomatic. The incidence of TAA in the United States ranges from 15,000 to 30,000.

Rapid Market Growth Expected

The endovascular stent-graft market will continue to expand rapidly for a number of reasons. One primary driver comprises increasing numbers of patients who will select this less-invasive procedure over the traditional open surgery with its longer recovery periods and higher rates of complications. In addition, the aging population will continue to expand, putting more people at risk for aneurysm. It is estimated that 5%–7% of those over age 65 has an AAA. Finally, implementation of screening programs will detect a greater number of cases of aortic aneurysm, thus leading to an increase in the number of endovascular stent-graft procedures. The chart on page 1, “Worldwide Market for AAA Stent-Grafts,” illustrates this growth. The first endovascular aortic grafts were available for use in the United States in 1999. Now there are four AAA endografts that are FDA-approved and available commercially in the United States for EVAR: Cook’s Zenith AAA, Endologix’ Powerlink, Medtronic’s AneuRx, and Gore’s Excluder. Gore is the only company with a TAA endograft (the Gore TAG) on the U.S. chart, “Developers of Endovascular Grafts for Abdominal and Thoracic Aneurysm Repair”). TAA endografts show great potential, not only for the treatment of TAA but also for other anomalies of the thoracic aorta, such as acute and chronic dissections, penetrating ulcers and traumatic injuries. U.S. research institutions are serving as clinical trial sites for next-generation aortic endografts made of synthetic fabrics. Boston Scientific’s TriVascular Enovus AAA and the Terumo/Vascutek Anaconda are examples of investigational endografts that incorporate new design features, taking into account varying patient morphology. market; other manufacturers’ devices are in development and/or are available outside the United States. TAA endografts show great potential, not only for the treatment of TAA but also for other anomalies of the thoracic aorta, such as acute and chronic dissections, penetrating ulcers and traumatic injuries. U.S. research institutions are serving as clinical trial sites for next-generation aortic endografts made of synthetic fabrics. Boston Scientific’s TriVascular Enovus AAA and the Terumo/Vascutek Anaconda are examples of investigational endografts that incorporate new design features, taking into account varying patient morphology.

The rate of EVAR should increase rapidly within the next decade with the advent of promising technologies such as lower-profile devices that allow percutaneous delivery and endostapling devices that offer increased durability as well as the ability to treat short, angulated necks. Imaging modalities used with EVAR also will continue to improve, providing greater accuracy for screening, as well as procedural and post-procedural surveillance needs.

Tags: medtech, aortic-aneurysm, stent, stent-graft