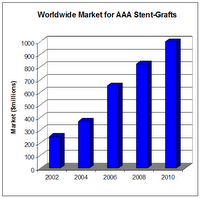

Stent-Grafts for AAA will represent a $1 billion market in less than five years.

Stent-Grafts for AAA will represent a $1 billion market in less than five years.Endovascular aortic repair (EVAR) is one of the most significant technological advances in vascular surgery over the last decade and continues to show promise as a less-invasive alternative to conventional surgery in treating patients with abdominal aortic aneurysms (AAAs) or thoracic aortic aneurysms (TAAs). As manufacturers make ongoing refinements to endovascular devices for aneurysm therapy, the estimated 2.7 million aortic aneurysm patients in the United States have more treatment options available than ever before. Although aneurysms are far less common than heart attacks, they are also far more fatal. According to the National Center for Health Statistics, roughly 15,000 patients die annually from ruptured aortic aneurysm, and this number may be low because the condition can be overlooked easily in a standard autopsy. Ruptured abdominal aneurysm is currently the 13th leading cause of death in the United States. In fact, as many as 2 of 3 patients with an AAA rupture die prior to reaching the hospital. Even with open surgery, there is an average 48% mortality rate associated with patients having a ruptured AAA. AAAs typically enlarge slowly and without symptoms, making them difficult to detect. However, detecting AAAs early and repairing them can decrease the death rate by one-sixth. TAAs are also under-diagnosed because most patients are asymptomatic. The incidence of TAA in the United States ranges from 15,000 to 30,000.

Rapid Market Growth Expected

The endovascular stent-graft market will continue to expand rapidly for a number of reasons. One primary driver comprises increasing numbers of patients who will select this less-invasive procedure over the traditional open surgery with its longer recovery periods and higher rates of complications. In addition, the aging population will continue to expand, putting more people at risk for aneurysm. It is estimated that 5%–7% of those over age 65 has an AAA. Finally, implementation of screening programs will detect a greater number of cases of aortic aneurysm, thus leading to an increase in the number of endovascular stent-graft procedures. The chart on page 1, “Worldwide Market for AAA Stent-Grafts,” illustrates this growth. The first endovascular aortic grafts were available for use in the United States in 1999. Now there are four AAA endografts that are FDA-approved and available commercially in the United States for EVAR: Cook’s Zenith AAA, Endologix’ Powerlink, Medtronic’s AneuRx, and Gore’s Excluder. Gore is the only company with a TAA endograft (the Gore TAG) on the U.S. chart, “Developers of Endovascular Grafts for Abdominal and Thoracic Aneurysm Repair”). TAA endografts show great potential, not only for the treatment of TAA but also for other anomalies of the thoracic aorta, such as acute and chronic dissections, penetrating ulcers and traumatic injuries. U.S. research institutions are serving as clinical trial sites for next-generation aortic endografts made of synthetic fabrics. Boston Scientific’s TriVascular Enovus AAA and the Terumo/Vascutek Anaconda are examples of investigational endografts that incorporate new design features, taking into account varying patient morphology. market; other manufacturers’ devices are in development and/or are available outside the United States. TAA endografts show great potential, not only for the treatment of TAA but also for other anomalies of the thoracic aorta, such as acute and chronic dissections, penetrating ulcers and traumatic injuries. U.S. research institutions are serving as clinical trial sites for next-generation aortic endografts made of synthetic fabrics. Boston Scientific’s TriVascular Enovus AAA and the Terumo/Vascutek Anaconda are examples of investigational endografts that incorporate new design features, taking into account varying patient morphology.

The rate of EVAR should increase rapidly within the next decade with the advent of promising technologies such as lower-profile devices that allow percutaneous delivery and endostapling devices that offer increased durability as well as the ability to treat short, angulated necks. Imaging modalities used with EVAR also will continue to improve, providing greater accuracy for screening, as well as procedural and post-procedural surveillance needs.

Tags: medtech, aortic-aneurysm, stent, stent-graft

No comments:

Post a Comment